Soya beans from Brazil are the fuel that Chinese workers need to see them through the day making the flatscreen TVs watched in the favelas of São Paulo.

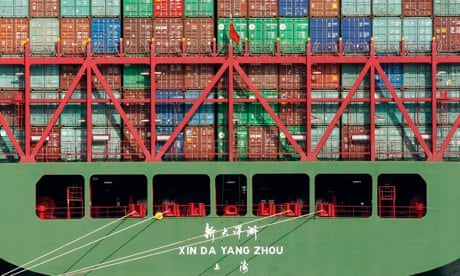

It's one element of China's dense cobweb of trade links that has propelled the world's second largest economy to be crowned the world's biggest trading nation.

China is Brazil's largest trading partner, and such is the importance of the relationship that the two countries signed a currency swap deal last year designed to allow each to continue trading should world financial markets freeze, as they did in 2008. The deal made clear that Beijing is working hard to prevent another banking crash getting in the way of feeding its 1.2 billion people.

The extent of China's global trade and even the size of its economy is the subject of much debate in the west. The figures released on Friday imply that export demand weakened in December, while domestic demand picked up speed. This fits with the central committee's plans to wean the economy off exports and shift production to domestic needs.

But analysis of the data by the consultants Capital Economics shows that, once distortions from the previous year are taken into account, the opposite is true. Foreign demand is healthy, and domestic demand is still subdued.

"The slowdown should not raise concerns about the state of foreign demand. It simply reflects the fact that exports surged in December 2012 as over-invoicing began to have a significant impact on the customs data. Looked at in seasonally-adjusted month on month terms, last month's export data were actually fairly encouraging," it said.

A World Bank report in 2008 questioned the purchasing power of average Chinese incomes after previous estimates of the country's stellar rise. It said per capita income in US dollars was 40% lower than previously estimated. A review by a group of economists, published in the latest Economic Journal, takes the World Bank figure and pushes it back up to 30%.

Monthly economic figures produced by Chinese state agencies are also hotly contested by analysts, many of whom believe that over-production of goods with increasing amounts of debt are a bigger problem for the economy than officials will admit.

These disputes aside, there is a consensus that exports will continue to grow over the next year and the trade surplus built up over the last two decades will inflate further. The world wants Chinese goods.

Chinese people also increasingly want Chinese goods. It's still the case that middle-income Chinese families are deeply suspicious of stuff made at home, which is why many buy their cosmetics and medicines from Korea and prefer western brands when safety is an issue. But during the country's biggest online shopping day of the year on 11 November – also the biggest in the world – the Wall Street Journal reported that the online trading site Alibaba.com recorded 35.2bn yuan (£3.5bn) in transactions. The sale illustrated the rising power of Chinese brands, with the smartphone maker Xiaomi and the electronics and appliances supplier Haier Electronics among the top sellers.

While most Chinese products are made from imported raw materials and demand at home and abroad is accelerating, Beijing is unlikely to surrender its crown as number one trading nation.

Apart from the US, the only loser is likely to be the Brazilian environment, which is being destroyed for soya production, albeit at a slower rate than in the early part of the century.

A Brazilian moratorium in 2005 ruled that soya grown on deforested land would not be exported. The moratorium covers 90% of Brazil's soybean exports, much of which is sold to China's pig farming industry. It runs out this month.

Comments (…)

Sign in or create your Guardian account to join the discussion