For many investors, it seems like any deal between Greece and its international creditors is better than no deal.

Europe is hatching an agreement to release 7.2 billion euros ($8 billion) in bailout loans to Greece, without which the country will default to the International Monetary Fund next week, and possibly tumble out of the eurozone.

Markets like the latest Greek proposal because it would deal with the immediate crisis, but it could store up trouble for the future.

Here are three big problems with the plan:

1. The wrong kind of savings

Left-wing Prime Minister Alexis Tsipras was elected in January on a promise to end years of austerity that contributed to a 25% slump in the Greek economy.

The reality of an accelerating bank run, and the prospect of a chaotic exit from the euro, have forced Tsipras to backpedal, but the budget savings he is now proposing risk prolonging the recession that Greece has sunk back into this year.

Related: Faces of Greece's euro dilemma

Experts say there's too much emphasis on raising taxes and pension contributions, and not enough on cutting spending or making the economy more flexible.

Berenberg chief economist Holger Schmieding said Greece risked repeating the mistakes of its first bailout program, by hitting demand in the economy too hard.

2. No debt relief

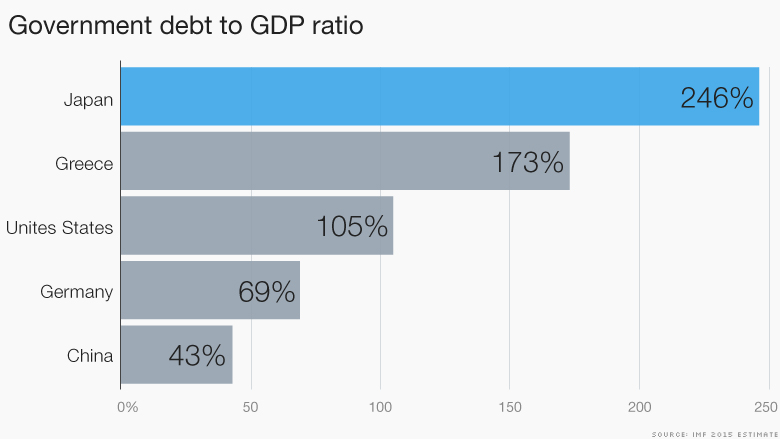

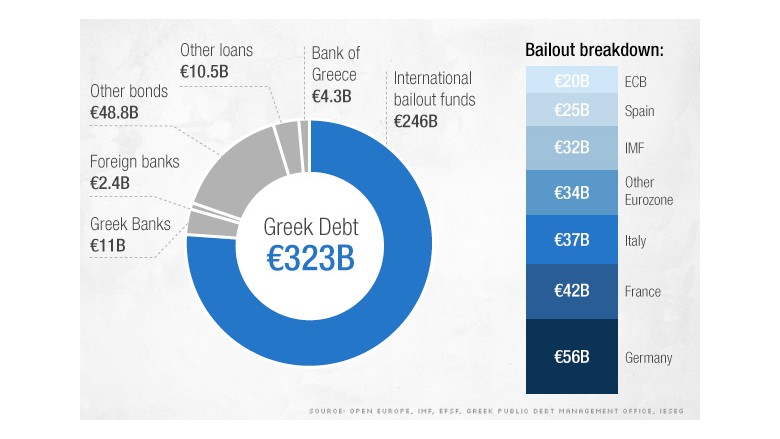

Greece has the second highest debt mountain in the world based on the size of its economy. Until recently Tsipras, and his combative finance minister Yanis Varoufakis, were insisting that relieving that burden had to be part of the agreement under discussion.

Senior European officials -- mindful that their own taxpayers won't accept a haircut on the money they've loaned Greece -- killed any talk of that Monday after a summit of eurozone leaders.

But economists say Greece won't grow fast enough, or generate big enough budget surpluses, to service its enormous debt any time soon -- even given the extremely low interest rates and deferred payment schedules attached to the international bailout loans.

"We disagree with the proposal's suggestion that the intended measures will lead to a return to debt sustainability for Greece within 10 years," commented analysts at UBS Wealth Management.

3. It won't last long

Assuming Tsipras can force the deal through the Greek parliament, and that key creditors such as the IMF and Germany accept it too, it will do little more than buy time for negotiations on yet another rescue.

The final tranche of cash from the existing bailout should be enough to meet repayments due to the IMF and European Central Bank through the end of August. But the Greek government will then have to find more than two billion euros for both institutions in September and October.

"If this week concludes with agreement between Greece and its creditors, it won't be long before the next chapter in this drama," said Angus Campbell, senior analyst at FxPro.

UBS estimates Greece may need additional funds of nearly 14 billion euros to carry it through to the end of 2015.

"Greece therefore needs a new funding program, a debt restructuring or a combination of the two," wrote analysts at the Swiss bank.