America's major banks are pouring millions of dollars into an apparently successful attempt to weaken Barack Obama's finance reform bill, currently stalled in Congress by Republican opposition.

In the face of deep public anger over the financial crisis and government bailouts, banks have flooded Congress with lobbyists seeking to curtail key parts of the sweeping regulatory bill – such as provisions to create an office for consumer protection and more strongly regulate the vast derivatives market.

JP Morgan Chase is at the forefront of lobby spending with $1.5m (£980,000) in the first quarter of this year alone – a sharp rise on the same period in 2009 – followed closely by Citigroup. Credit Suisse and Goldman Sachs have also spent more than $1m on lobbying Congress this year, more than double their previous spending.

The banking industry is second only to healthcare interests in the amount it spends on political lobbying.

Last year, America's eight leading banks and finance houses spent $30m to influence legislation. The broader financial industry has more than 2,600 lobbyists registered with Congress.

The battle over the finance reform bill is principally driven by politics, with Republicans making a unified stand against it in an attempt to inflict an embarrassing defeat on Obama – or at least force a climbdown – ahead of the mid-term elections.

But Dave Levinthal of the Centre for Responsive Politics (CRP), which monitors the flow of lobby money, said that the influence of lobbyists swarming over Capitol Hill can be seen in the fate of individual elements of the legislation.

"It's remarkable that in a year in which the economy was in tatters that financial institutions would be spending more on lobbying than they ever have," he said. "We can tell that there are things that are not in the bill that would have been there if it wasn't for the concerted lobbying. Robust consumer protection for instance. It's very watered down."

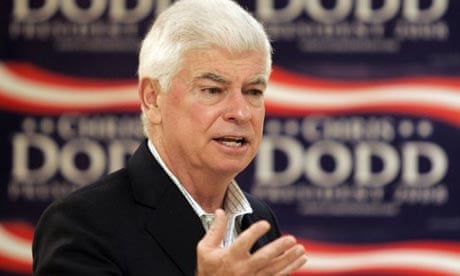

Christopher Dodd, the chairman of the Senate banking committee who is a prime mover behind the legislation, in February criticised the "refusal of large (banking) firms to work constructively with Congress."

"Too many people in the industry have decided to invest in an army of lobbyists, whose only mission is to kill the common-sense financial reforms that we are working so hard up here to try to achieve," he said.

In parallel with the vast amounts poured into direct lobbying, the finance industry has also steered funds to individual members of Congress in campaign contributions, albeit with mixed results.

According to the CRP, major donors gave more to Democrats than Republicans, with JP Morgan Chase again at the forefront. Foreign-owned banks are also involved. The Royal Bank of Scotland has made $111,650 in political donations so far this year, the vast bulk of it to Democrats.

The single largest recipient of banking donations is Dodd, who has taken a total of $1.2m for his campaign fund.

Levinthal said individual campaign donations buy access even if they do not always have the intended influence over the outcome of legislation.

During his presidential election campaign, Obama received $39m from the finance and insurance industry, including nearly $1m from Goldman Sachs.