When Donald Trump was sworn in as president last January, the nation faced several domestic crises. In many places, infrastructure is a disaster, highlighted by the I-35 bridge collapse in Minneapolis, Flint’s perilous water system and New York’s decaying, delay-plagued subways.

Then there’s the largely unrecognized retirement crisis. One-third of American workers are saving nothing for retirement, and more and more workers in their late 60s and early 70s say they simply don’t have the money to retire.

The US also faces a college affordability and student debt crisis. A year at a public university typically costs more than $20,000 – a hefty price tag for many families when median household income is $59,000. Total student loan debt has soared above $1.3tn, and more than two-thirds of college graduates borrow to go to school. Their average debt upon graduation is about $35,000, triple the level of two decades ago.

And the poverty crisis has not gone away. Nearly 41 million Americans live below the poverty line, with nearly one in five children living in poverty.

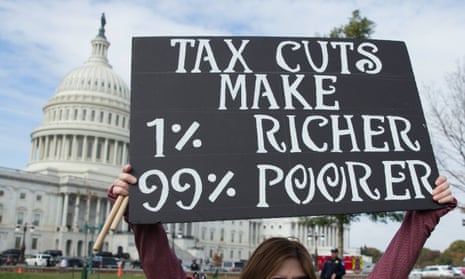

Unfortunately, Mr Trump and Congress have largely ignored these crises since inauguration day. Instead, turning their backs on good governance, the president and congressional Republicans are focused like a laser beam on heaping riches on two constituencies that are definitely not in crisis: corporations and the wealthiest Americans.

Corporation profits are near their highest levels in history, while revenues from the corporate income tax have dropped to just 2% of GDP, down from 6% in the 1950s. And the richest 1% of Americans now receive 20% of overall national income, double the level in 1980 and the highest level in nearly a century – since the Roaring Twenties. Real after-tax income for households in the top 1% has nearly tripled since 1980, rising more than four times faster than for middle-class households.

Even though corporate America and the rich are doing more than fine, the Trump administration and Congress are rushing to push through tax cuts that mainly help business and the wealthiest Americans. A recent Washington Post headline said it all: “Senate tax bill would cut taxes of wealthy and increase taxes on families earning less than $75,000 by 2027.”

The Republican tax plan goes out of its way to reward those who least need additional financial rewards, and there is evidently only one reason Republican lawmakers are doing this – to please ultra-wealthy campaign donors and corporate donors who hate taxes and are demanding that Trump and the Republicans rack up some, indeed any, legislative “win”.

Sadly, there have not been congressional hearings to examine and shine some light on what would be the biggest tax overhaul in three decades.

A very unfortunate, but little-discussed aspect of the legislation is that by increasing the national debt by a projected $1.5tn, and perhaps $2tn, the plan would make it far harder for the nation to address the pressing domestic crises I mentioned above – and that doesn’t even include the damage from Hurricanes Harvey, Irma and Maria.

In some ways, the tax plan, believe it or not, would worsen several of our domestic crises. Amazingly, Congress’s own joint committee on taxation has found that the Senate plan would, in the out years, raise taxes most percentage-wise on the poorest households, specifically those making less than $30,000 a year.

With millions of senior citizens facing a financial squeeze or downright poverty, the tax bill would make things worse for many seniors by triggering an automatic $25bn cut in Medicare next year – and probably more such cuts in subsequent years.

As the federal deficit and debt soar because of the tax plan, congressional Republicans will no doubt push all the harder to rein in deficits by cutting social security and Medicare, further hurting the nation’s senior citizens. And that at a time when social security is a lifeline for millions of seniors – one-third of Americans over age 65 receive 90% or more of their income from social security.

The tax bill would unarguably exacerbate the college affordability crisis. In what looks like a concerted assault on higher education, the legislation would vastly increase taxes on more than 100,000 graduate students, end the tax break for student loans and make employer-provided tuition assistance taxable. Moreover, by taxing university endowments for the first time, the legislation would mean that many schools have less money for student financial aid.

During last year’s campaign, in a move cheered by blue-collar voters, Mr Trump vowed to spend $1tn on infrastructure – to rebuild the nation’s decaying roads, bridges, airports and rails. But the Trump administration has consigned infrastructure to the back burner, and Mr Trump’s promise of $1tn has mysteriously been replaced by talk of just $200bn.

With the tax plan expected to balloon the national debt by $1.5tn, don’t be surprised if many Republican lawmakers – who traditionally rail against increased spending – end up fighting all out against any halfway ambitious infrastructure plan.

In many ways, the Republican tax plan is a hypocrisy generator. Many Republicans who repeatedly thundered against deficits when Obama was president now can’t wait to increase the nation’s deficits and debt so long as it means tax cuts.

Bob Corker has said he would oppose a tax plan that increases the deficit – will he stay true to his word or be hypocritical? Susan Collins has said she’ll oppose any tax bill that cuts taxes for millionaires – will she adhere to that promise or turn hypocritical. John McCain says he will oppose legislation unless the Senate returns to regular order with real hearings – will he be true to his word? Jeff Flake has denounced the ocean of Trump lies. Will he now vote for a bill that’s marketed with falsehood after falsehood, among them that the bill will only increase taxes on millionaires and that the tax cuts will somehow pay for themselves?

In short, the Republicans’ tax plan is a rejection of good governance and sound policy. It would comfort the already very comfortable and further afflict many of the afflicted – all while causing the national debt to soar and leaving less money to address the true crises our nation faces.